You’ve probably heard the term 401(k) at least a thousand times, and you might even have some of your own money invested in one.

But exactly what is a 401(k)? And how does a 401(k) work?

Those are the questions I’m going to answer in this article. And I’m going to answer them in plain English, so by the time you reach the end of this page you’ll be an official 401(k) expert!

Now, I’m not a financial advisor, but I do work in the 401(k) industry in my day job. That industry background means I understand 401(k) plans better than most people.

Sadly, that’s not saying much.

In my experience, the average American barely understands how a 401(k) works.

And the financial services industry doesn’t exactly make it easy for you to understand, does it?

Take a look at the 401(k) paperwork they gave you when you started your job and tell me how helpful it is.

If it’s like most documents I’ve seen it uses complicated jargon written by lawyers who like to make things as confusing as possible.

But that doesn’t really help people like you me, does it?

You don’t have time to read through the hundreds of pages of paperwork that makes up your enrollment package, summary plan description, deferral election form, beneficiary designation form, fee disclosure, and investment option paperwork.

What you need is a simple 401(k) guide that explains everything to you in simple, easy to understand language.

And that’s why I created this page.

But this is more than just a 401(k) for dummies type of post. My goal is to make this the ultimate resource for people who have questions about how a 401(k) works.

Now before we get too far, let me make a couple of quick points about this guide.

First, when a company is first setting up a 401(k) plan they have many different options to choose from, which means not all plans are created equal.

Think of it like the difference in cars. Your car might have a moon roof, a luggage rack, and leather seats. I could have the same model but without any of those extra features.

Same basic car, but very different in several important ways.

The same goes for 401(k) plans and since there is an almost infinite variety of options, I can’t possibly go over every single combination.

Instead, I’ll go over the most common features with the understanding that some of the sections below may not apply to your individual situation.

Secondly, I am not a financial advisor and anything I say is strictly my own opinion and shouldn’t be taken as advice.

What Is A 401(k) Plan In Simplest Terms?

In simple terms, a 401(k) plan is a type of savings plan that allows you to set aside a portion of your paycheck and invest it for retirement.

Contributions are deducted from your paycheck before taxes so you get a tax break with each contribution you make.

As long as you keep the money within the 401(k) account you won’t pay any taxes until you retire and withdraw the funds.

SIDE NOTE – 401(k) isn’t the sexiest of names, and people often misinterpret it as 41K plan or a 4o1k plan. The 401(k) got its super exciting name from the section of the Internal Revenue Code that explains it. So, the next time you have nothing better to do, grab a copy of the Internal Revenue Code and turn to Section 401(k) so you can see for yourself.

How Does A 401(k) Work?

Okay, there’s a lot to go over so let’s take it one step at a time…

401(k) Eligibility Rules

You can’t just go to a bank or a website and sign up for a 401(k) on your own. Your employer has to decide to offer a 401(k) to its employees.

If you work for a very large company you almost certainly have access to a 401(k) plan. But smaller companies may not want to be bothered with the hassle or added expense of offering a 401(k).

Even if your company does have a 401(k) plan, you might need to meet age and service requirements before you become eligible to participate.

In general, you must be allowed to participate in the 401(k) plan as long as you have reached age 21 and have at least one year of service with your employer.

Keep in mind those are the maximum requirements you may need to meet. Your employer may not have any age or service requirements at all, or they may set them at something less than 21 and 1 year.

For example, they might limit the plan only to employees who are over 18 and have worked at the company for 6 months.

Some plans do exclude entire classes of employees no matter how old you are or how long you’ve worked there. Union workers and part-timers are types of employees who are often excluded from 401(k) plans.

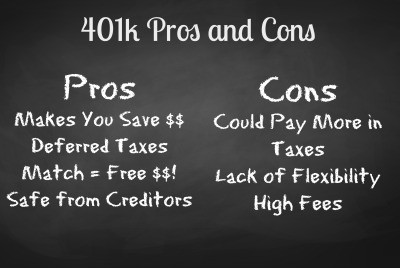

What Are The Benefits Of A 401(k)?

When I think about the benefits of contributing to a 401(k), there are four things that jump out at me.

Forced Savings

How many times have you heard personal finance experts stress the importance of paying yourself first?

Heck, it’s one of the most fundamental rules of building wealth. By paying yourself first you’re making sure that your savings goals are being funded before you waste your money on that new video game or kitchen gadget.

Investing through a 401(k) plan makes saving easy and painless. Once you sign up, the money comes out of your paycheck automatically. You don’t have to worry about making a separate deposit or transferring money on your bank’s website.

It just happens automatically, so even the laziest among us can save for retirement.

Tax Benefits

One of the advantages of saving through a 401(k) is the ability to contribute a portion of your paycheck pretax.

For example, let’s say your monthly income is $5,000. If you contribute $500 per month into your 401(k) you will only pay taxes on $4,500 instead of $5,000.

That lowers your taxable income and reduces the amount of tax you’ll pay.

Plus, the dividends and capital gains earned on your 401(k) investments are tax-deferred. That means you won’t be taxed on them at all until you start withdrawing money from the plan.

Deferring taxes on those earnings will allow them to grow faster which is great for your bottom line.

Employer Contributions

Many employers will actually make contributions to your plan too.

For example, a typical employer contribution might be 50 percent of the first 6 percent you contribute. If you earn $60,000 a year and contribute 6 percent of your salary ($3,600) the company will contribute 50 percent of that amount into your account.

That’s $1,800 in free money!

If your company has a really good year they might even make an additional contribution, such as a Discretionary Match or a Non-Elective Contribution (NEC).

You don’t need to worry much about those, but if you get them consider it a bonus.

Protection From Creditors

Hopefully this will never be an issue for you, but if you find yourself in debt and creditors are coming after you it’s good to know that your retirement savings are safe.

Generally, creditors are not allowed to take your retirement savings and your 401(k) is also protected during bankruptcy proceedings.

401(k) Disadvantages

Of course, 401(k) plans aren’t all sunshine and lollipops. They have their downsides too.

Taxes

While being able to contribute pre-tax money into your 401(k) and letting it grow tax free is a definite advantage, there’s another side to the story.

When you start withdrawing money from your 401(k) it gets taxed as income at whatever tax bracket you happen to fall into. That will be much higher than the long-term capital gains tax you would owe if you had invested that money outside of a 401(k).

If you earn around $100,000, your income would be taxed at 24 percent. But long-term capital gains taxes top out at the far lower 15 percent for most people, and 20 percent for those with higher incomes.

Lack of Flexibility

Your 401(k) doesn’t work like a savings account at a bank. It’s designed to be used for retirement savings, so in general it’s very difficult to take money out early.

Most plans do provide ways for you to access your money when you really need it through loans or hardship withdrawals but as you’ll see later in the article those have disadvantages of their own.

When you put money into a retirement savings account you should expect to leave it there for years to come. A 401(k) is definitely not a good place for your emergency fund.

Staggering Fees

Another problem with 401(k) plans are the high fees that eat away at your account balance.

A report issued by the Investment Company Institute found that an average working couple making a combined $30,000 and contributing five percent to their 401(k) would pay an obscene $154,794 in fees.

If that same couple earned $90,000, they’d pay a mind-boggling $277,000 in fees!

The worst part is that the fees are hidden and difficult to find. They’re built into the funds themselves in the form of an expense ratio and you probably have to do some digging to figure how much you’re being charged.

When you compare the investment options available to you pay close attention to the fees charged.

The lower the fees the better.

Look for index funds or passively managed target date funds which will usually have fees that are just a fraction of what the actively managed funds charge.

Let’s quickly recap the pros and cons of a 401(k) plan:

How To Enroll In A 401(k) Plan

Once you become eligible to join your company’s 401(k) plan, you should receive an enrollment package containing some important documents including:

- A summary plan description outlining how the plan works

- A salary deferral election form so you can choose how much you want to contribute and which funds you want to invest your money in

- A beneficiary designation form to indicate who will receive the assets if you die. If you are married this will be your spouse

You might receive an actual paper package containing these documents, but these days most employers allow you to enroll into the 401(k) plan online.

Automatic Enrollment

Some plans don’t even require you to enroll in them. They will actually sign you up automatically unless you tell them not to.

This is called negative enrollment or automatic enrollment.

Those people who never took the time to read through the documents and notices they received are often surprised when they notice their paycheck gets smaller and money starts going into their 401(k) plan.

Fortunately for them, they typically have an option to withdraw your money within a 90 day window beginning with the date of the first automatic contribution.

How Much Can I Contribute To A 401(k) Plan?

The government wants you to save for retirement. That’s why they offer tax savings on any contributions you make.

But they don’t want you to save too much, right? They still need a healthy dose of tax income to keep the country running.

So, they put a limit on how much you’re allowed to contribute to a 401(k) plan.

In 2018, the 401(k) contribution limit is $18,500. If you’re 50 or older you can make an additional catch up contribution of $6,000 for a total of $24,500.

That’s just the money you contribute yourself. If you include employer contributions the limit jumps all the way $55,000.

The chart below shows the maximum contribution (also known as the 402(g) limit) you can make this year and in previous years.

The chart below shows the maximum contribution (also known as the 402(g) limit) you can make this year and in previous years.

402(g) Limits

| Your Age | 2019 | 2018 | 2017 |

|---|---|---|---|

| Under 50 | $19,500 | $18,500 | $18,000 |

| 50 or Older | $25,000 | $24,500 | $24,000 |

What Is A Roth 401(k)?

A variation on the traditional 401(k) is the Roth 401(k). They are very similar, except the taxation and distribution rules for Roth 401(k) plans are different.

With a traditional 401(k), contributions are made with pre-tax money and they will reduce your taxes in the year you make them. When you withdraw money from the plan it will be taxed at normal income levels.

On the other hand, Roth 401(k) contributions are made with after tax money. You don’t get a tax break on them now but if you follow the rules your distributions will be tax free when you take them out.

Your Roth contributions themselves are already taxed when you put them into the plan so they don’t get taxed again when you take that money out. Even better, if your contributions are in the plan for a minimum of five years, the earnings accrued on them will be tax free too.

So the choice between a Roth 401(k) vs traditional 401(k) comes down to what your future tax rate will be in the future.

If you think your tax rate in the future will be lower than it is today, then the traditional 401(k) makes sense. This way, you’ll avoid paying taxes on your contributions now when your tax rate is higher.

If you’re in a lower tax bracket now and expect to be in a higher bracket at retirement, the a Roth 401(k) would make sense since you would pay the taxes upfront when the tax bill is smaller.

Of course, no one knows what will happen to tax rates in the future.

So rather than flipping a coin or going with a hunch, perhaps your best bet is to hedge your bets. Many 401(k) plans allow you to split your contributions and have half go into your account as pre-tax money and the other half go into a Roth as after-tax money.

This option reduces your risk and gives you the best of both worlds.

How Do I Invest My 401(k) Money?

The investment options available within your 401(k) plan depend on who your employer has partnered with to operate the plan.

For example, Fidelity will offer a different set of funds than John Hancock.

Regardless of who operates the plan, you will have a range of mutual fund choices that focus on different types of investments.

You should have a cash or money market fund, a bond fund, index funds, and funds that focus on various types of stock such as small companies, large companies, international companies, etc.

Some plans may even offer a brokerage option where you can invest in individual company stocks.

I can’t tell you which funds you should invest in, but most people would agree that you shouldn’t put all of your eggs in one basket.

Instead, divide your investments into a mix of cash, bonds, and stocks. This strategy, known as asset allocation, aims to reduce risk by spreading your investments across different asset categories.

Many 401(k) plans also offer target-date funds, which automate the process of asset allocation for you.

Target-date funds are tailored to a specific retirement date. For example, a 2040 fund would invest with an asset allocation designed for someone expecting to retire in 2040.

As that year gets closer the mix of investments would be updated automatically to adjust for different risk levels.

Target-date funds have become popular because they offer a more hands-off experience.

Whatever fund choices you make, be aware of the impact that fees and expenses will have on your investments.

Some funds charge more than others and the difference can be substantial over many years. Review your fund options carefully to see the expense ratio for each.

What is 401(k) Vesting?

Vesting is just a fancy word for ownership.

You’re always fully vested in any 401(k) contributions you make from your own paycheck. That money is yours to keep no matter what.

But contributions made by your employer are different.

Some 401(k) plans offer immediate vesting, which is awesome. That means you don’t need to meet any service requirements at all and the employer match belongs to you immediately.

But most plans aren’t so generous and they make you stay with the company for a certain period of time before you “own” the employer contributions.

If you leave before you are fully vested you’ll forfeit, or give back, the unvested portion of your 401(k) account.

There are two types of 401(k) vesting schedules that can be used by a plan: graded vesting and cliff vesting.

With a graded vesting schedule, you start off at zero vesting and become more vested the longer you work there.

Here’s an example of a typical graded vesting schedule:

| Years of Service with Employer | Vesting Percentage |

|---|---|

| 1 | Zero |

| 2 | 20 Percent |

| 3 | 40 Percent |

| 4 | 60 Percent |

| 5 | 80 Percent |

| 6 | 100 Percent |

Your plan’s 401(k) vesting schedule may be more generous than this example, but thanks to the Pension Protection Act of 2006, it can’t be any more restrictive.

With a cliff vesting schedule there is no gradual increase in your vesting, you simply go from no vesting at all and skip right to 100 percent. Here’s an example:

| Years of Service with Employer | Vesting Percentage |

|---|---|

| 1 | Zero |

| 2 | Zero |

| 3 | 100 Percent |

A Real-Life Example

Let’s say your employer’s 401(k) plan follows the graded vesting schedule outlined above. You work there for three and a half years and over that time your company contributes matching contributions of $10,000.

When you leave, you have reached forty percent vesting so you will be allowed to keep $4,000 of those employer contributions. The other $6,000 will be forfeited and you’ll lose your claim to it.

401(k) Distribution Rules

Your 401(k) is meant to be used for retirement savings. It’s not a piggy bank to be cracked open to pay for a vacation or a new car.

That said, life happens. Sometimes you find yourself in a financial crunch and if that happens there are some ways to tap into your 401(k) account.

Let’s start with the options available to you while you’re still employed by the company and then we’ll talk about how to withdraw money from your 401(k) after you switch companies or retire.

401(k) Loans

If you need quick cash and you don’t have an emergency fund to tap into, you may consider borrowing from your 401(k) rather than using your credit card or taking out a bank loan.

Not all plans allow loans, but most do.

According to IRS 401(k) loan rules, you can borrow the lesser of $50,000 or half of your vested balance.

So, if you have a vested balance of $200,000 you can borrow the max of $50,000. If you only have $10,000 in your 401(k), you can only borrow $5,000.

The money you borrow from your 401(k) is usually paid back through payroll deductions, so you don’t have to worry about missing a payment. It just comes out of your check automatically.

The maximum term for most 401(k) loans is five years, though that can be extended if you are using the funds to purchase a home.

Before you take out a 401(k) loan, let’s first consider some advantages and disadvantages.

401(k) Loan Advantages

- You can use the money for whatever you want and don’t need to explain how you plan to spend it.

- The interest rate is likely lower than what you’d pay through another lender.

- You’re essentially borrowing money from yourself so the interest is repaid back into your account.

- As long as you pay the loan back there are no tax consequences.

401(k) Loan Disadvantages

- While a 401(k) loan is not taxed, there are still transaction fees which can be costly.

- The money you borrow won’t grow because it’s not invested. If the market is going up you could miss out on significant earnings.

- Loan repayments are made with after-tax dollars that will be taxed again when you withdraw them.

- If you leave your job before paying back the loan, the full amount becomes due. If you can’t pay it back the outstanding balance is treated as a taxable distribution. You’ll owe tax on the full amount, plus a 10 percent penalty tax if you’re under age 59 ½.

401(k) Hardship Withdrawals

Unlike loans, 401(k) hardship withdrawals are not repaid into the plan.

If your plan allows for hardship withdrawals (most do) you can take money out of your 401(k) for any of the six IRS approved reasons below:

- Unreimbursed medical expenses

- Costs related to the purchase of your home

- Tuition and related educational expenses and fees

- Payments needed to prevent foreclosure or eviction from your home

- Funeral or burial expenses

- Expenses for the repair of damage to your home

401(k) hardship withdrawal rules require you to provide documentation to prove you have an actual hardship. You can’t just say “trust me” and take out as much as you like.

You will have to pay normal income taxes on your 401(k) hardship withdrawal. Plus, you’ll also be subject to a 10 percent penalty tax if you are under the age of 59 1/2.

What If I Leave My Job?

If you switch jobs, you’ll have a few options to consider for your 401(k) account.

You can leave it where it is with your old employer’s plan. Most plans allow this but if you have a small balance (under $5,000) they may force you to take it out.

You can cash out your 401(k), though I strongly recommend against this option.

Sure getting a large lump sum of cash is great, but there are some serious consequences.

First, you’ll get a hefty tax bill. Not only is the full amount considered taxable income but if you’re under 59 1/2 you’ll also get hit with a ten percent penalty tax.

Ouch!

Secondly, you’ll be wiping out everything you had saved for retirement and you’ll have to start all over again.

Assuming your new employer offers a 401(k) plan of its own, you can roll your balance into this new plan without paying taxes on it. Consolidating the two accounts will make tracking and managing your retirement savings easier.

Or, you can roll your 401(k) money into an Individual Retirement Account (IRA). Again, you won’t pay taxes on the money rolled over and an IRA may have a greater selection of investment options compared to a 401(k).

You can open an IRA with any number of companies. Vanguard and Fidelity are two very popular low-cost options.

Your 401(k) After Retirement

So what options are available to you after you retire?

Well, one option is to leave your money in the 401(k) plan and take withdrawals as you need them. This can be a pain as you’ll have to deal with your former company to get your money out and 401(k) fees can be hefty compared to other options.

Once you reach retirement age you can withdraw money from your 401(k) without paying any penalty tax (though you will still owe normal income tax on any withdrawals).

Another option is to cash out your 401(k) and keep it somewhere else. You can avoid being taxed on the entire amount by rolling it into an IRA. Then you can still take distributions as needed and have easier access to your money if you need it.

Many people choose to take a lump sum amount in cash and roll the rest over to an IRA. This way they can use a portion of their 401(k) balance to treat themselves to a vacation or do some home renovations while keeping the bulk of their money for their retirement years.

Summary

The 401(k) plan is not perfect, but it is an important tool for the average American who wants to save money for retirement.

Your money will grow tax free until you take it out and that is a big advantage. Over many years, steady 401(k) contributions can grow into a sizable nest egg.

Start contributing as soon as you can and make sure you’re putting in at least enough to receive any employer matching contributions. Remember, that’s free money and it would be silly to pass that up.

401(k) FAQs

Question – Why did I receive a refund of my 401(k) contribution?

Answer – If you contributed to a 401(k) plan and then received a refund for a portion of your contributions, your employer’s plan likely failed one of several tests that 401(k) plans must meet each year.

I won’t go into detail here (I could write another entire post about 401(k) testing) but the government requires 401(k) plans to pass certain tests to ensure that highly compensated employees (HCEs) aren’t benefiting more than the lower paid workers.

If a plan fails one of these non-discrimination tests it must refund some of the contributions made by the highest paid employees. In some cases, they can make as additional contribution to the lower paid employees so the HCEs do not have to receive refunds.

Question – What is a safe harbor 401(k) plan?

Answer – A safe harbor 401(k) is a specific type of plan that is structured in a way to pass or avoid non-discrimination testing. In order to qualify as a safe harbor, a plan must meet more stringent contribution and vesting requirements.

Safe harbors are more common among very small employers who may have trouble passing 401(k) tests otherwise.

Question – What’s this about getting a 401(k) match on my student loan payments? Is that for real?

Answer – A new ruling by the IRS might just make it possible for you to both pay down your student loans and save for retirement.

It’s still early and there are many details to be worked out, but here’s what we know so far.

The ruling technically only applies to a single employer who specifically asked the IRS for an opinion because they wanted to offer an employer match to their employees who are saddled with student loans. The IRS opinion letter states that the specific provisions suggested by this company do not violate any sections of the code.

That’s great news!

Because if one company is looking to offer this benefit and the IRS says it is okay then you expect many others to be interested and before long this will likely be written directly into the code and offered widespread.

Here’s a breakdown of how the match would work in the specific example laid out in the IRS ruling (keep in mind your company’s match could be different):

Let’s say you earn $4,000 per month. As long as you make a student loan payment equal to at least 2 percent of your pay ($80), you’d receive a student loan repayment non-elective contribution (SLR NEC) of 5 percent ($200) into your 401(k) at the end of the year.

So just like that you’d have $2,400 contributed into your 401(k) and all you had to do was continue making your student loan payments on time!

But wait:

It’s important to remember that nothing is finalized yet. It’s possible there will be no government support for this idea and it will never get off the ground.

BUT, I think it will happen. Student loan debt is a huge problem and I think this is an effective way for people to pay down their debt and save for their future at the same time.

It may take some time to hammer out all the details and the final product might not look exactly like what we’ve heard so far, but personally I think it’s only a matter of time.

A Final Note

I worked really hard on this article to make it the most complete and ultimate 401(k) guide. I edited it again and again to make sure I explained everything in the simplest terms possible so even a 401(k) novice could understand the concepts.

If you found this guide helpful, please take a moment and share it on Pinterest, Facebook, Twitter, or wherever else you like to hang out. Spreading the word is the best way you can help Wealthy Turtle and I truly appreciate your support.